When shipping goods into Australia it is imperative that you prepare and submit all the required documentation. Failure to do so can result in significant delays and penalties.

It is important to understand that all goods entering Australia must be declared to Australian Customs and Border Protection (ABF). This includes prohibited items such as drugs, steroids, weapons and protected wildlife.

Personal Effects and Household Goods

Whether you’re moving home, changing locations or relocating your business to Australia, the process of importing your goods is complex. There are specific shipping, labelling and customs clearance requirements that must be followed to ensure that your shipment arrives safely. In most cases, it’s best to use a licensed customs broker to complete the import process.

A customs broker is a person or company licensed by the Australian Border Force to act on your behalf during the import process. They can help you with all the paperwork, including completing an import declaration. They can also assist you with obtaining any necessary permits and making sure that your goods meet the appropriate biosecurity requirements.

To import personal effects and household goods into Australia, you must submit an Import Declaration. This document includes information about the goods, the importer, how they’re being transported and their tariff classification and customs value. It also outlines any applicable duties, GST or charges. This document must be lodged electronically via ICS or a paper lodgement can be accepted.

Before bringing anything into Australia, check the ABF’s website to see if it requires a permit or has any other biosecurity restrictions. Some items, such as plants, minerals and animal products, need to be quarantined, inspected and treated for pests or diseases to avoid introducing them into the country.

Commercial Goods

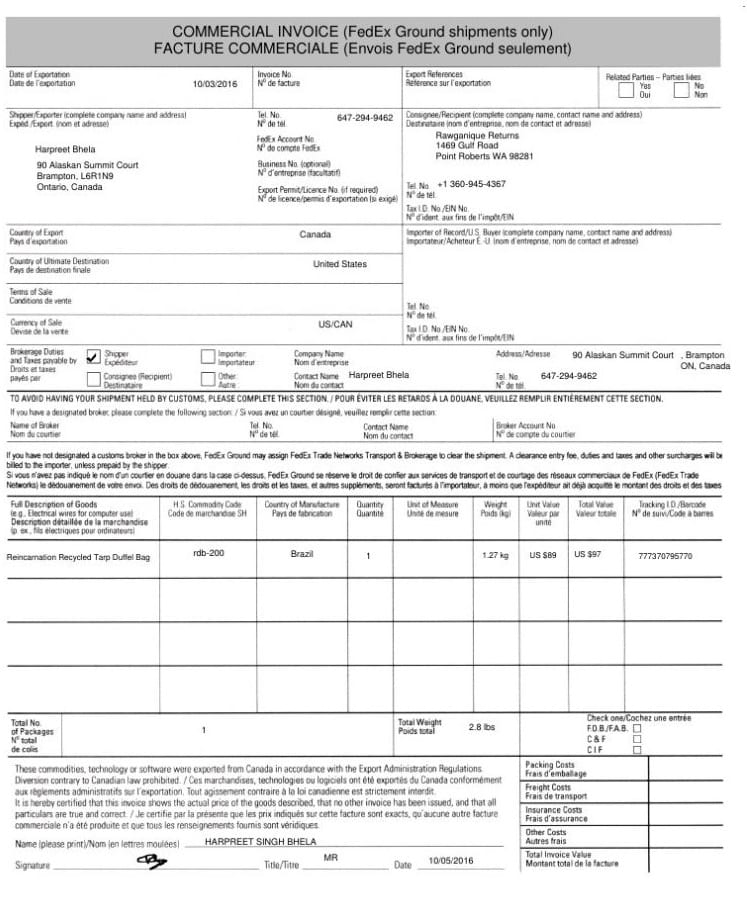

If you’re importing commercial goods into Australia, there are a number of documents required for customs clearance. These documents include the Import Declaration, which includes information on the importer, how the goods are being transported and their tariff classification and Customs Value. In some cases, you may also be required to supply a commercial invoice and/or a packing list, depending on your products.

All goods must go through accurate valuation in order to estimate the relevant duties, charges and taxes. This valuation is based on the transaction (or fair market) value of the goods. In some instances, it is necessary to obtain additional information on the goods from other sources, such as a datasheet or product information guide.

Depending on the nature of your goods, you may need to obtain permits to clear them from customs control. You can check if your products require permits by checking the Australian Border Force website for detailed information on import regulations.

If your goods arrive by air cargo and have a Customs Value of AUD $1,000 or less, you can lodge a Self-assessed Clearance (SAC) declaration at the airport. If your goods are in a licensed warehouse prior to clearing, you can lodge a Warehouse Declaration (N20). If your shipment contains timber, straw or bark, it is also required that these materials are fumigated before they reach Australia. This is because these materials are at risk of developing pests and fungi in the long transport time to Australia.

Import Permits

The importation of goods to Australia can be subject to charges, duties and taxes depending on their value and classification. You should check the Australian Government website for details on the tariff classification of your goods to avoid surprises when you come to pay them. You will also need to accurately value your goods to estimate the tariffs you will need to pay. The most common method of valuation is by transaction value.

You cannot bring certain prohibited items into Australia, such as illegal drugs or firearm weapons. Other goods are prohibited because they pose a biosecurity risk, such as certain plant and animal products. You can get permission to import these goods if you meet certain conditions. Check the Biosecurity Import Conditions system (BICON) to see if your goods are eligible.

If your goods do require a permit, you will need to supply the department with an Import Declaration (N10), Self-Assessed Clearance (SAC) declaration or Warehouse Declaration (N20). These forms will differ depending on the nature of your shipment and how it is arriving into Australia, for example by air freight or sea freight. You will also need to provide additional documents and proof of permits if required. If you vary an import permit, a service fee will apply. Keeping your permits up to date will reduce the likelihood of incurring this charge.

Customs Declarations

Unless exempt, most imported goods into Australia are liable for duties and taxes. Importers may need to obtain permits and provide the correct documentation for clearance from customs control. It’s also important to ensure goods comply with labelling regulations, especially if the importer is registered for GST (or intends to be).

An Import Declaration must be lodged by the person or company importing the good into Australia and is required for all goods, regardless of their value. The declaration provides transparency to ABF and forms the basis for duty and tax calculations. It is recommended that a licensed Customs Broker prepares this declaration on behalf of the importer.

The declaration must include the full name of the importer, their Australian Business Number (ABN), a description of the goods including quantity and value, a tariff classification, the country of origin, and any relevant GST information. If the goods are destined for use in a licensed warehouse, the declaration must also include a Warehouse Declaration.

A physical examination of the goods may be conducted through X-ray or other means, and ABF officers will sometimes use detection dogs. This is particularly common for goods that are of concern due to biosecurity concerns, such as plants and animal products. If goods require treatment to be cleared from the biosecurity regime, you may need to register with NICNAS and pay registration fees.